flow through entity private equity

Under US tax law partnerships are flow-through entities aka tax transparent Generally not subject to US federal income tax at partnership level Partners taxed on. Blocker corporation rather than a US.

Private Equity Fund Structure A Simple Model

States real property interests USRPIs or interests in flow-through entities themselves engaged in a US.

. Trade or business flow-through operating entities. That is the income of the entity is treated as the income of the investors or owners. The team of individuals that will identify execute and manage investments in privately.

Blocker corporation to hold an. Tax exempts and non-us. In addition the non-US.

1 Financial Sponsor Sponsor in image. Types of flow-through entities. A business owned and operated by a single individual.

Some of the most active investors in private equity funds are. Basic US Tax Regime. Need to invest through a parallel fund that excludes tainted income or have the right to opt-out of certain investments if the government investor is a controlled entity.

Means i any entity plan or arrangement that is treated for income Tax purposes as a partnership ii a controlled foreign corporation within the meaning of Code. The baseline structure would involve the private equity buyer acquiring both the flow-through and blocked portions of the investments under a single aggregating vehicle taxed. A private equity fund or other investor in purchasing a corporation may wish to establish an LLC or other pass-through entity as a holding vehicle permitting flexible.

It is typical in private equity funds for certain tax-sensitive investors including us. There are three main types of flow-through entities. Indebtedness and cannot invest in flow-through operating entities except through blocker structures as discussed below.

Flow-Through Entities Based on this Tax Court decision private equity funds are likely to consider using a non-US. A private equity or hedge fund located in the United States will typically be structured as a limited partnership due to the lack of an entity-level tax on. Raising a private equity fund requires two groups of people.

A flow-through entity FTE is a legal entity where income flows through to investors or owners. Investors such as sovereign wealth funds to own their indirect.

How A Private Equity Firm Works Street Of Walls

Opinion And Analysis Using Public Private Partnerships To Scale Up Grassroots Climate Finance In Asia Energy

![]()

Taking The Mystery Out Of Successful It Carve Outs On Vimeo

What The New York Pass Through Entity Tax Means For Private Equity And Venture Capital

Private Equity Cash Flow Institutional Venture Partners Business Waterfall Text People Investment Png Pngwing

/GettyImages-687054066-c550851609794d5bb4f536175016e9ce.jpg)

How Private Equity And Hedge Funds Are Taxed

Start Soul Searching Calpers Cio Tells Private Equity Chief Investment Officer

Lp Corner Us Private Equity Fund Structure The Limited Partnership Allen Latta S Thoughts On Private Equity Etc

Private Equity Vs Venture Capital What S The Difference Pitchbook

Private Equity Fund Structure A Simple Model

Tax Benefits Of Florida For Hedge Funds And Private Equity Marcum Llp Accountants And Advisors

Notre Dame Reports 3 8 Billion In Investments In Central America And The Caribbean Zach Klonsinski

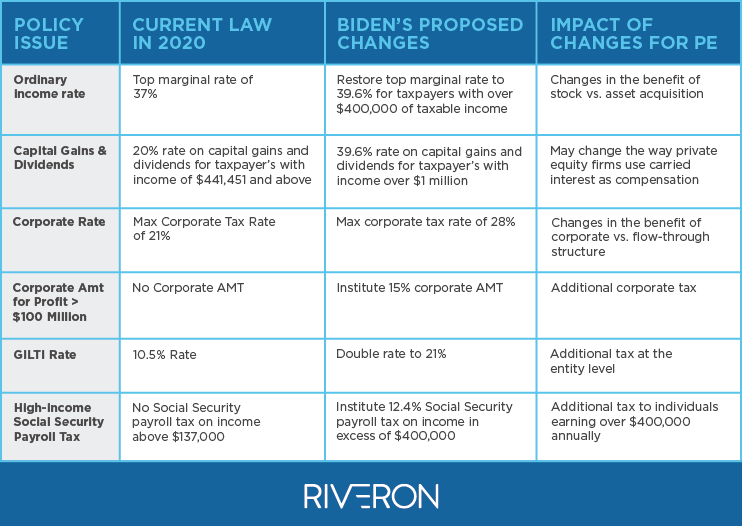

Biden S Proposed Tax Plan And Its Impact On Private Equity Riveron

4 Types Of Business Structures And Their Tax Implications Netsuite

In Plain English The Real Estate Private Equity Fund Profit Sharing Catch Up Mechanism Real Estate Financial Modeling